What is MRR? Understanding Monthly Recurring Revenue

Contents

- Introduction: The Importance of MRR in Business

- Defining Monthly Recurring Revenue (MRR)

- What MRR is NOT

- Why MRR Matters: Key Benefits and Insights

- MRR Movements: Key Components of MRR

- Calculating MRR: Key Concerns and Methods

- Strategies for Optimizing MRR and Sustaining Growth

- Conclusion

- Related Metrics

- Frequently Asked Questions about MRR

Introduction: The Importance of MRR in Business

In today's competitive business landscape, understanding and optimizing key performance indicators (KPIs) is essential for success. One such KPI is Monthly Recurring Revenue (MRR), a critical metric for businesses with a subscription-based model. In this comprehensive guide, we will delve into the concept of MRR, its significance, components, calculation methods, and how to optimize it for sustainable growth.

Defining Monthly Recurring Revenue (MRR)

Monthly Recurring Revenue (MRR) is a point in time, normalized performance financial metric that represents the predictable revenue a business generates from its customers on a monthly basis. It is the revenue that a business can reasonably expect to earn in a given month from paying customers. The metric is a measurement of subscription growth and momentum. MRR is most commonly used by subscription-based businesses, such as Software-as-a-Service (SaaS) companies, as it provides a clear snapshot of revenue performance and helps forecast future earnings.

What MRR is NOT

Sometimes people intertwine concepts and it might be important to explicitly identify what MRR is NOT.

- MRR is not cashflow. Remember that MRR is a normalized revenue. If you have an annual subscription of $100, you would receive $100 from your customer one time per year, not $8.33 every month. Therefore, do not mistake MRR for cash flow.

- MRR is not GAAP revenue. GAAP revenue is the recognition of revenue using a set of accounting principles and generally accepted in the United States and reported on a company's income statement. There are no official accounting principles or definitions for how MRR is calculated, but it is a normalized point in time performance metric that reflects the revenue that a business can reasonably expect to earn in the short term. MRR should never be reported as GAAP revenue.

- MRR is not GAAP revenue recognition. Depending on the accrual method of revenue recognition the MRR may or may not be a reasonable proxy for revenue recognition. But again, they are two different things and MRR should not be reported as GAAP revenue recognition. Let’s take an example where you recognize revenue on a daily basis. We’ll assume the business has a single customer with a single annual subscription of $120. As we can see in looking at a few consecutive months, the change in GAAP revenue is quite significant from month to month due to the difference in length of each month, no other factors involved. This adds a lot of unneeded complexity when trying to simply understand if a businesses subscription revenue is growing and at what rate.

| January | February | March | |

|---|---|---|---|

| MRR | $120/12 = $10 | $120/12 = $10 | $120/12 = $10 |

| % Change In MRR From Previous Month | 0% | 0% | 0% |

| GAAP Recognized Revenue | $120/365*31 = $10.19 | $120/365*28 = $9.21 | $120/365*31 = $10.19 |

| % Change In Rev. Rec. From Previous Month | 0% | -9.62% | 9.62% |

Why MRR Matters: Key Benefits and Insights

MRR is an essential KPI for several reasons:

- Revenue Predictability: MRR enables businesses to forecast their revenue with a higher degree of accuracy. This predictability is crucial for financial planning, budgeting, and resource allocation.

- Subscription Growth and Momentum: MRR enables businesses to understand the pace at which they are growing their subscriber base. This is essential in understanding the health of a SaaS business, especially in the short term.

- Product Market Fit: MRR provides great clarity on the product market fit of your product or service. The growth rate, or momentum that you have with your MRR gives great insight as to if you need to keep improving your product, or if you need to invest more in sales and marketing.

- Churn Rate Analysis: MRR allows businesses to monitor customer MRR gross churn rate, which is the percentage of customer MRR that cancel or contract their subscription within a given period. A low churn rate signifies strong customer retention and satisfaction.

- Growth and Expansion Opportunities: By tracking MRR, businesses can identify trends and growth opportunities, enabling them to make informed decisions about product development, marketing, and sales strategies.

MRR Movements: Key Components of MRR

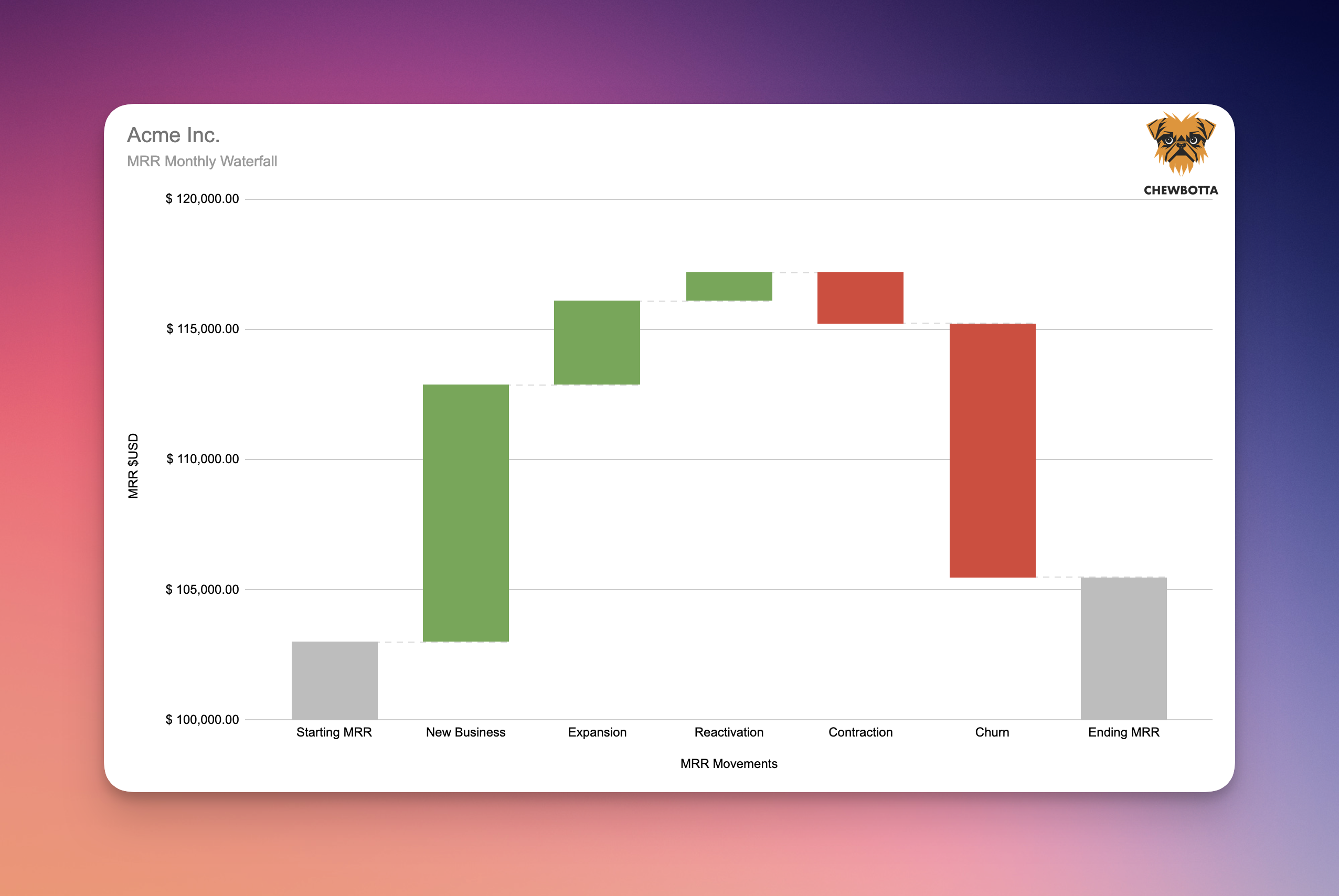

There are really 5 key components of MRR. The MRR associated with any given subscription, and thus the whole of your MRR across all of your subscriptions, can only change in one of 5 ways. Some of these movements will cause your MRR to increase while others will cause your MRR to decrease. The components are:

- New Business MRR. When a customer pays you for the very first time for a repeating subscription, that MRR is new business. New business causes your MRR to increase.

- Expansion MRR. There are a few ways that your MRR can expand (MRR increases), but the most obvious one is your customer upgrades by adding a secondary subscription, or adding seats to their existing subscription, etc. Less obvious ways that MRR expands might be a discount code that expires on a subscription.

- Contraction MRR. Likewise, MRR can contract (MRR decreases) when a customer downgrades their subscription, perhaps removing a subscription or reducing the number of seats. Other ways MRR could contract is giving a discount, or a customer sidegrades from a monthly plan to an annual plan that is cheaper on an annualized basis.

- Churn MRR. If a customer cancels all of their subscriptions (or their final subscription) then that is considered churned MRR.

- Reactivation MRR. Finally, a customer may not be gone forever. If a customer churns and then later signs up for a subscription for your product or service, they would be considered Reactivated MRR.

Figure. SaaS MRR Movements Waterfall Diagram

There are less common things that can cause MRR to change. For example if your business charges in multiple currencies and/or collects in one currency but reports in another currency, foreign exchange rates could play a role in MRR fluctuations. This is worth noting, but not typically included in MRR movements.

Calculating MRR: Key Concerns and Methods

There are several methods to calculate MRR, depending on the type of subscriptions and pricing models a business offers. Most companies have complexities that render many of the short cuts for approximating MRR useless or difficult to use. The quick and dirty way to calculate MRR is to take your monthly ARPA (average revenue per account) and multiply that by the number of subscribers. The complexity comes along quickly because most companies have customers that are on monthly, quarterly, and yearly plans, and customers that are switching amongst various plans intra billing period.At Chewbotta we subscribe to the approach of calculating MRR on a subscription basis, and then summing the MRR across all subscriptions for the point in time of interest. We also subscribe to the concept of doing this by analyzing invoice data to determine what the customer actually paid and for what service period.

Things that need to be considered when calculating MRR is the service period (full period or prorated), are any discounts involved, are taxes involved, have refunds or credits been applied, among a number of other things.

As mentioned above, there is no standard definition for calculating MRR. Thus, any two systems (Stripe / ChartMogul / Chargebee) might all take a given situation and calculate the MRR slightly differently. This is especially true when strange edge cases occur such as prorated refunds, plan changes during a dunning period, etc.

Basic Examples:

Most subscription based businesses offer a variety of subscription durations, typically ranging from monthly to annual with some offering quarterly or semi-annual plans. All subscription lengths that are not monthly are normalized and represented as a monthly value.

Example 1, an annual subscription for $100 would be represented as $100 / 12 = $8.33 in MRR. Example 2, a daily subscription for $1 would be represented as $1*365.25 / 12 = $30.44 in MRR.

In either example, should the subscription eventually be upgraded or downgraded during the current subscription period, a prorated adjustment would be applied to calculate the MRR movement and the new MRR value for the subscription.

Strategies for Optimizing MRR and Sustaining Growth

To maximize MRR, businesses should focus on the following strategies:

- Improve Customer Retention: Retaining customers is crucial for MRR growth. Invest in customer success initiatives, provide exceptional customer support, and regularly gather feedback to understand and address customer needs.

- Upsell and Cross-sell: Encourage existing customers to upgrade to higher-tier plans or purchase additional products and services. This can boost MRR without the need for new customer acquisition.

- Optimize Pricing Strategies: Regularly evaluate and adjust pricing strategies to ensure they align with market trends, customer expectations, and the value delivered by the product or service.

- Expand Target Markets: Explore new markets and customer segments to increase the customer base and MRR.

- Win Back Former Customers: It’s cheaper to win back a former customer than it is to go out and find a new customer. Many times customers churn for reasons that are not final, and win back campaigns can be effective in getting old customers back.

- Analyze and Adapt: Continuously monitor MRR and related metrics to identify trends and areas for improvement. Be prepared to adapt strategies and tactics based on data-driven insights.

Conclusion: The Power of MRR for Subscription-Based Businesses

In conclusion, understanding and effectively utilizing Monthly Recurring Revenue (MRR) is vital for subscription-based businesses. MRR provides valuable insights into revenue performance and momentum, churn rate, and growth opportunities. By calculating MRR accurately and implementing strategies to optimize it, businesses can achieve sustainable growth and stay ahead in the competitive landscape.

Remember, the key to successfully leveraging MRR lies in continuously monitoring, analyzing, and adapting to the evolving market conditions and customer needs. Stay proactive in refining your product offerings, pricing strategies, and customer retention initiatives to maximize your MRR and drive long-term success.

Related Metrics

- Annual Run Rate (ARR)

- New Business MRR

- Expansion MRR

- Contraction MRR

- Churn MRR

- Reactivation MRR

Frequently Asked Questions about MRR

To further enhance your understanding of MRR, we have compiled a list of frequently asked questions:

How does MRR differ from total revenue?

MRR specifically measures the recurring revenue from subscriptions, while total revenue includes all revenue streams, such as one-time sales, non-recurring services, or other non-recurring sources.

What is Gross MRR Churn Rate?

Gross MRR Churn Rate is a key metric that helps businesses with a subscription-based model measure the change in MRR within a specific period, accounting for lost revenue due to customer contractions and churn. This metric is crucial in understanding customer retention and revenue stability, as it highlights the extent to which a business can maintain its recurring revenue over time.

What is Net MRR Churn Rate?

Net MRR Churn Rate is an important metric for subscription-based businesses that measures the overall change in MRR within a specific period, accounting for both lost revenue due to customer churn and contraction, and gained revenue through expansion and reactivation. By incorporating both aspects, the Net MRR Churn Rate provides a more comprehensive picture of a company's revenue performance and customer retention.

How can I track MRR in real-time?

Several tools and platforms, such as ChartMogul, Baremetrics, ProfitWell, and Chewbotta offer real-time MRR tracking and analytics to help businesses monitor and optimize their recurring revenue performance.

Why does MRR not match revenue?

MRR is a point in time normalized financial metric that takes the value and service period of the contracted subscription and normalizes it over a monthly basis. In cash basis revenue accrual 100% of the contract value would be recognized in the month that payment was received. In accrual accounting revenue accrual, revenue is recognized at the time the revenue is earned (typically spread over the contract service period using predefined rules).

Should MRR include discounts?

Discounts should be deducted when calculating MRR.

Should MRR include taxes collected?

Taxes collected should be deducted when calculating MRR.

Should MRR include refunds?

Refunds should be deducted from a subscription when calculating MRR.

How is MRR calculated by companies?

Several tools and platforms, such as ChartMogul, Baremetrics, ProfitWell, and Chewbotta offer real-time MRR tracking and analytics to help businesses monitor and optimize their recurring revenue performance. Some subscription payment platforms also provide basic MRR metrics in their dashboards.